From Application to Cash in 48 Hours: Real Stories of Businesses Saved by MCAs

Introduction: When Time Is Everything

In business, time is capital. A delayed invoice, a sudden opportunity, or an unexpected bill can make or break your cash flow. Traditional loans? They take weeks—or even months—to process. But Merchant Cash Advances (MCAs) are changing the game by putting fast, flexible, and accessible funding in the hands of small business owners when they need it most.

Smart Business Funding specializes in getting capital to businesses in as little as 24 to 48 hours—even for those with bad credit, seasonal income, or inconsistent revenue. And we’re not just talking theory. We’re talking real results.

In this article, we’ll show you how MCAs are saving businesses, driving growth, and turning “no” into “go”—fast. These are the stories of business owners who got the cash they needed, right when they needed it.

Table of Contents

- What is a Merchant Cash Advance (MCA)?

- Why Traditional Loans Fail Small Businesses

- How MCAs Work (And Why Speed Matters)

- Real Stories: Businesses Saved by MCAs

- Story #1: The Restaurant on the Brink

- Story #2: The Retailer with a Golden Opportunity

- Story #3: The Contractor Who Couldn’t Wait

- Story #4: The Healthcare Clinic in Crisis

- Story #5: The Salon That Bounced Back

- What Makes Smart Business Funding Different

- Is an MCA Right for You?

- Conclusion: Don’t Let Cash Flow Kill Your Business

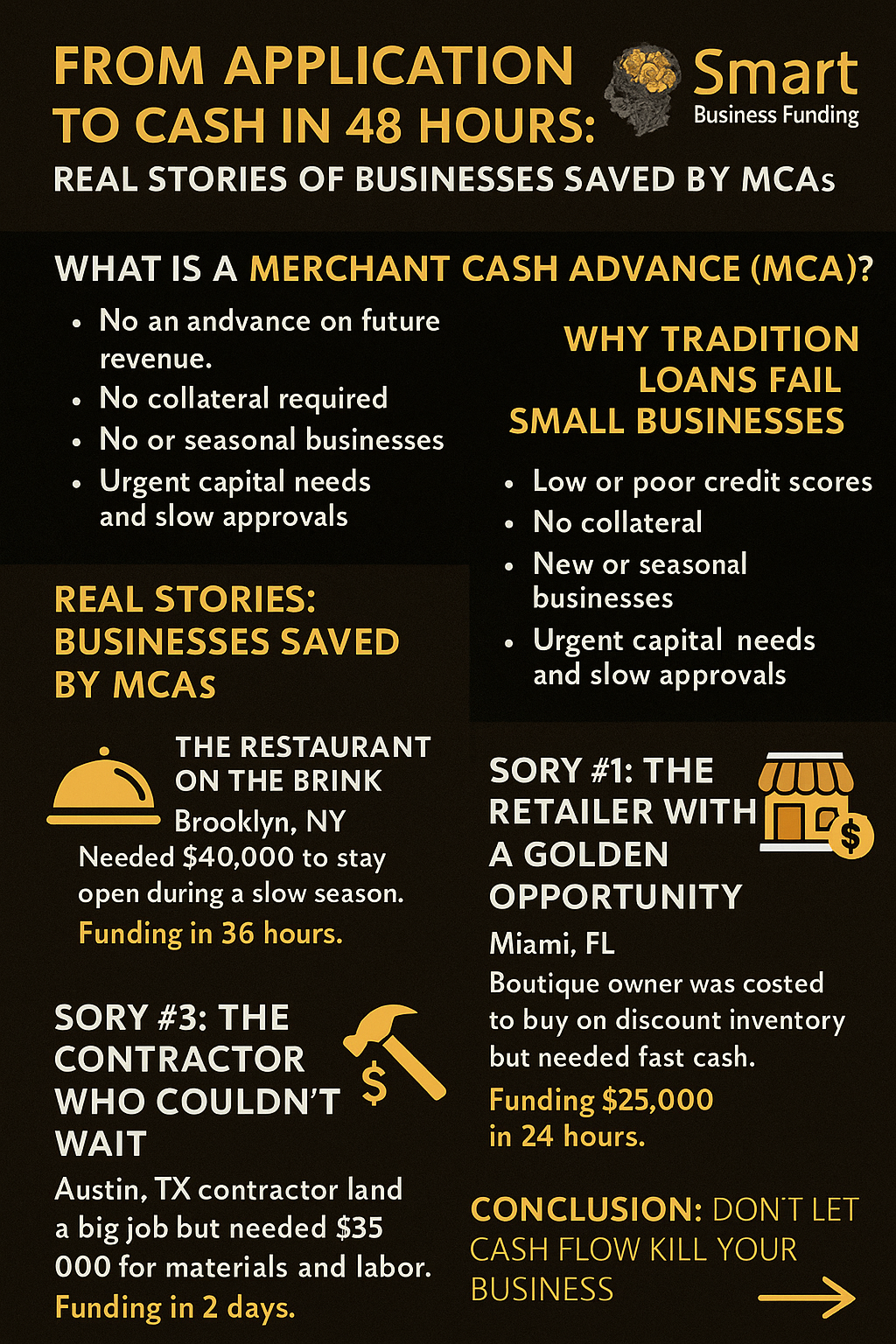

What is a Merchant Cash Advance (MCA)?

A Merchant Cash Advance is not a loan. Instead, it’s an advance on your future revenue. You receive a lump sum of capital upfront, and you repay it through a percentage of your daily or weekly sales.

Key benefits:

- ✅ No collateral required

- ✅ Bad credit OK

- ✅ No fixed payment schedule

- ✅ Funding in 24–48 hours

That makes it perfect for businesses that need bad credit business funding, fast business funding, or emergency business funding without the red tape.

Why Traditional Loans Fail Small Businesses

Banks still operate in a world of FICO scores and strict criteria. Here’s why they often say “no” when you need capital most:

- ❌ Low or poor credit scores

- ❌ No collateral

- ❌ New or seasonal businesses

- ❌ Urgent capital needs

- ❌ Complicated paperwork and slow approvals

When you’re facing a cash flow crunch, waiting weeks for a loan approval simply isn’t an option.

How MCAs Work (And Why Speed Matters)

When you apply for a Merchant Cash Advance from Smart Business Funding, we look at your business revenue, not your credit score. Our process is streamlined, often requiring just three months of bank statements and a short application.

📈 Within 24 to 48 hours, you can get approved and funded. That’s what makes MCAs a game-changer in working capital advance and alternative business funding.

Real Stories: Businesses Saved by MCAs

Story #1: The Restaurant on the Brink

📍 Brooklyn, NY

A popular local restaurant was hit hard during the slow post-holiday months. With rent due and inventory low, the owner feared shutting down. A bank turned her away due to low credit.

✅ Smart Business Funding stepped in and funded her in 36 hours. She replenished supplies, paid staff, and stayed afloat—without putting up her home or business as collateral.

Keywords: bad credit business funding, emergency business funding, flexible business capital

Story #2: The Retailer with a Golden Opportunity

📍 Miami, FL

A boutique owner was offered a bulk inventory deal at 40% off—but needed cash fast to act. A bank required a 3-week underwriting process.

✅ We funded her $25,000 within 24 hours. She jumped on the deal, doubled her inventory, and saw a 60% profit increase that month.

Keywords: fast business funding, business funding for retail, working capital for small business

Story #3: The Contractor Who Couldn’t Wait

📍 Austin, TX

A construction contractor landed a $200,000 job but needed cash upfront for materials and labor. His credit score? 580. The bank wouldn’t touch it.

✅ We funded $35,000 in two days—and his crew was on site the next morning.

Keywords: business funding, working capital advance, bad credit business funding

Story #4: The Healthcare Clinic in Crisis

📍 Chicago, IL

A clinic’s billing cycle delayed reimbursements, and payroll was coming up. Traditional financing was unavailable due to their high accounts receivable volume.

✅ Smart Business Funding provided $50,000 in 48 hours, keeping their doctors paid and patients cared for.

Keywords: emergency business funding, fast capital, business loan alternatives

Story #5: The Salon That Bounced Back

📍 Atlanta, GA

After a flood shut them down for a week, a local salon lost nearly $10,000 in revenue. With repairs needed and no insurance payout yet, they were in trouble.

✅ We approved and funded $15,000 same-day. The salon reopened within 72 hours.

Keywords: alternative business funding, merchant cash advance, flexible business capital

What Makes Smart Business Funding Different

At Smart Business Funding, we go beyond just delivering cash fast—we support real businesses with real needs.

Here’s what sets us apart:

- ⚡ Funding in 24–48 hours

- ✅ No collateral needed

- 📝 Minimal paperwork

- 💳 We approve bad credit

- 🔁 Flexible repayments based on your revenue

- 📞 Human support—no call centers

Whether you need working capital for small business, bad credit business funding, or a merchant cash advance you can actually afford, we’re here for it.

Is an MCA Right for You?

Ask yourself:

- Do I need cash faster than a bank can provide?

- Do I have strong daily or weekly sales, even if my credit is low?

- Can I handle flexible payments based on my cash flow?

- Is this capital going to solve a real problem or fuel growth?

If you said yes to any of these, a Merchant Cash Advance from Smart Business Funding may be the smart move.

Conclusion: Don’t Let Cash Flow Kill Your Business

In today’s fast-moving business world, waiting for banks to say “maybe” just doesn’t cut it. That’s why so many business owners are turning to merchant cash advances—especially when they have bad credit, need emergency business funding, or are ready to seize growth opportunities fast.

Smart Business Funding is proud to help small businesses not just survive—but thrive.

📞 Ready to apply?

You could get approved and funded in 48 hours or less.

➡️ Visit SmartBusinessFunding.com to get started.